Home > Library

Search results : interest rate

2023-03-14This USPTO patent publication delves into our algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

2023-03-03This research article delves into mutual causation between stock market alphas and macroeconomic innovations.

2022-09-21This ebook delves into key financial topics and stock market investment articles.

2022-04-14This ebook delves into the modern collection of prescient New Keynesian macro economic insights with personal annotations and reflections.

2022-03-18This ebook delves into the modern collection of prescient macro economic insights with personal annotations and reflections.

2020-06-06This ebook delves into key financial topics and stock investment memes blog posts and essays.

2020-02-02This analytic report shines fresh light on the current global economic outlook as of February 2020.

2019-08-07This analytic report shines fresh light on the current global economic outlook as of August 2019.

2012-12-12This research article empirically shows the mysterious and inexorable nexus between credit default swap spreads and interest rate surprises.

2023-02-28 10:27:00 Tuesday ET

Basic income reforms can contribute to better health care, public infrastructure, education, technology, and residential protection. Philippe Van Parijs

2018-01-29 07:38:00 Monday ET

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protect

2017-08-13 09:36:00 Sunday ET

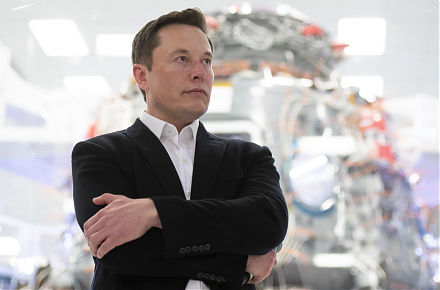

Several investors and billionaires such as George Soros, Warren Buffett, Carl Icahn, and Howard Marks suggest that the time may be ripe for a major financia

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2018-08-29 10:37:00 Wednesday ET

In an exclusive interview with Bloomberg, President Trump criticizes the World Trade Organization (WTO), proposes indexing capital gains taxes to inflation